Oil Prices Spike as US Insists All Countries Stop Iranian Imports

Voice of America

23 Apr 2019, 23:37 GMT+10

Oil prices reached a six-month high Tuesday after the Trump administration announced it would no longer exempt countries from U.S. sanctions, if they continue to buy Iranian crude oil, a move aimed at imposing a complete oil embargo on Iran.

Waivers granted to eight countries, including big Iranian crude importers China, India, Japan, Turkey and South Korea, are due to expire on May 2.

RBC Capital Markets, a global investment bank, has told clients it anticipates a loss of 700,000 to 800,000 barrels of oil a day from markets as a consequence of the waivers-withdrawal.

That will tighten oil supplies as seasonal demand picks up in the Northern Hemisphere, forcing importers to seek alternative supplies, a search made more challenging with production falling off in Venezuela and Libya because of domestic unrest and conflict.

U.S. sanctions were snapped back on Iran last year when President Donald Trump withdrew from a 2015 nuclear deal, signed by his predecessor Barack Obama, in which Tehran agreed to nuclear curbs in return for sanctions relief.

The European Union has been at loggerheads with Washington over Iran and the nuclear deal, which the Trump administration fears only delays Iran from developing nuclear weapons.

Today I am announcing that we will no longer grant any exemptions, Mike Pompeo, the U.S. secretary of state, said Tuesday. Were going to zero. We will continue to enforce sanctions and monitor compliance. Any nation or entity interacting with Iran should do its diligence and err on the side of caution. The risks are simply not going to be worth the benefits, he added.

The Trump administration gave waivers last year to avoid a price spike.

Some oil analysts are predicting the price of a barrel could rise to $80 as a result of the withdrawal of the exemptions and say the Trump administration may have to release oil from the U.S. Strategic Petroleum Reserve, an emergency supply of up to 727 million barrels, if the administration wants to keep prices low.

There isn't much doubt about the trigger for the latest rally, with Trump's decision not to extend waivers on imports of Iranian oil beyond May unsurprisingly providing further upward pressure, according to Craig Erlam, an oil market analyst at OANDA, a U.S. currency brokerage.

Saudi Arabia and the United Arab Emirates have said they will in principle increase production, but are unlikely to do so before a meeting in June of the 14 members of the Organization of the Petroleum Exporting Countries (OPEC). Analysts say they will want to wait to see the effect of the withdrawal of exemptions before committing to make up the shortfall on the international market.

Last year, OPEC countries increased production when the Trump administration first announced the return of U.S. sanctions on Iran.

Brent crude and West Texas Intermediate oil have surged in price more than 30 percent this year because of production disruptions in Venezuela, Nigeria, and Libya.

Amrita Sen, chief oil analyst of Energy Aspects, a research consultancy, says a jump in OPEC cartel production wont necessarily keep prices in check. The problem we have is the quality of the crude. Iran produces a lot of medium to heavy crudes, whereas the spare capacity in Saudi Arabia and the UAE is of lighter crudes. The quality issue is going to become a very big problem, she says.

One of the big questions when it comes to oil prices is whether importers decide to comply with the U.S. demand to stop buying Iranian oil.

Sen says China has made very strong statements it is within its legitimate rights to do business with Iran. 'We think Iranian exports will still be about 600,000 to 700,000 barrels per day. And if prices rise quite substantially and compensates for the drop of 500,000 to 600,000 the revenue shortfall [for Iran] might not be that substantial, Sen added.

In retaliation for the withdrawal of waivers, Iran has threatened to close the Strait of Hormuz, the only sea passage from the Persian Gulf to the open ocean and one of the world's most strategically important maritime choke-points. Few analysts believe Iran will follow through on its threat as it would risk a firm U.S. response and undermine Tehrans efforts to keep Europeans wedded to the 2015 nuclear deal.

More likely is Iran will use proxy wars in the region, in Syria and Yemen, to retaliate, they say.

The U.S. withdrew from the nuclear deal in part because, it said, Iran was failing to act like a normal country. Trump officials laid down a dozen conditions Tehran would have to fulfill for sanctions to be lifted, including an end to all uranium enrichment, stopping its support of Hezbollah, Lebanons radical Shiite movement, and other militant groups including Hamas, Islamic Jihad, and Houthi rebels in Yemen.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionPresident of Ecuador meets Envoy of UAE's Minister of Foreign Affairs

UAE and Ecuador governments explore ways to promote joint partnership and constructive cooperation Omar Sultan Al Olama: Under...

FM Nirmala Sitharaman embarks on official visit to Spain, Portugal and Brazil from June 30 to July 5

New Delhi [India], June 30 (ANI): Union Minister for Finance & Corporate Affairs Nirmala Sitharaman will lead the Indian delegation...

(SP)U.S.-MIAMI-FOOTBALL-FIFA CLUB WORLD CUP-CR FLAMENGO VS BAYERN MUNICH

(250630) -- MIAMI, June 30, 2025 (Xinhua) -- Wesley (L) of CR Flamengo tackles during the round of 16 match between CR Flamengo of...

India women's hockey team suffers 2-3 defeat against China, gets relegated from FIH Hockey Pro League

Berlin [Germany], June 29 (ANI): The Indian women's hockey team ended their FIH Hockey Pro League 2024-25 campaign with a 2-3 loss...

Mickey Arthur set to oversee Rangpur Riders' GSL title defence remotely

Rangpur [Bangladesh], June 29 (ANI): Former Pakistan head coach Mickey Arthur will be in charge of Rangpur Riders' Global Super League...

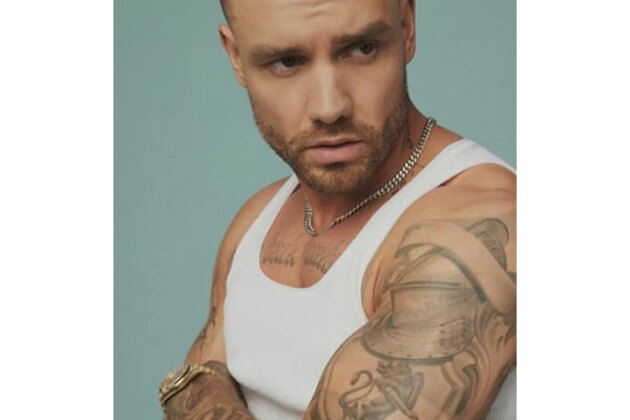

Liam Payne's sisters react to late singer's final project 'Building the Band'

Washington [US], June 29 (ANI): The sisters of late singer Liam Payne, Ruth Gibbins and Nicola Payne, have shared heartfelt messages...

Business

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...