BP CEO says he?ll sell oil projects to meet climate targets

News24

12 Sep 2019, 23:48 GMT+10

BP's CEO plans to sell some oil projects and curb the development of others to align its business with the Paris accord, the latest sign climate concerns are starting to impact the investment decisions of the world's largest fossil fuel producers.

Senior BP executives met within the last few days to discuss how to cut carbon as it grapples with a shareholder resolution requiring the company to explain how its spending is aligned with Paris, Chief Executive Officer Bob Dudley said on a Wednesday conference call organised by JPMorgan Chase & Co.

One proposal weighed up by BP's management team was exiting the most carbon-intensive projects, though Dudley wouldn't say which assets were targets because there are "governments and partners involved."

"We are certain we've got a path, it may not be linear, to being consistent with Paris goals," Dudley said in conversation with JPMorgan's head of European oil research Christyan Malek. "There are going to be projects that we don't do, things that we might have done in the past. Certain kinds of oil, for example, that has a different carbon footprint."

READ: Saudi Arabia's new prince of oil is a lifelong energy insider

His comments offer a response to increasingly severe criticism aimed at the entire oil industry over its contribution to man-made climate change. BP's own shareholders sparred with company managers at its annual general meeting in May, before voting almost unanimously to require the company to issue a report about how each new investment is aligned with Paris. The report will be issued before its next AGM in May 2020.

Still, the plan may prompt questions about how selling assets to another producer can possibly help curb global emissions. For example, Dudley said on the call that the sale last month of BP's oil and gas fields in Alaska helped it reduce its carbon footprint. But the buyer plans to invest more in the fields than BP would have, potentially increasing production and boosting emissions in the process.Dudley also pointed out the main drive of the Alaska sale was the fact those fields were struggling to compete for capital within BP because production there was unlikely to grow as much as at the company's other projects.

READ: Climate change behind Zim's power problems - Energy Minister

Dudley said he's juggling with the challenge of investing in relatively low-return renewables businesses while maintaining the company's large dividend. He took aim at those who didn't acknowledge how beneficial it is when BP does invest in low-carbon technology, saying any assessment of

its carbon footprint should probably include the emissions it avoids."We'll reduce the emissions from our operations, reduce the emissions from our products and come up with the new business models," he said. "If you add all those figures up in reductions of greenhouse gas - for example, we have a big solar business, a big bio-fuel, wind business - you almost get no credit when you do those calculations."

Paris accord

While he has maintained the company's business model already with with the Paris accord, he said having to issue a report to benchmark progress has caused the company to think further about its spending.A report by Carbon Tracker last week said BP's most polluting investments are the Zinia 2 project in Angola and the Azeri-Chirag-Gunashli development in Azerbaijan, and that neither of those developments are compatible with the Paris goals.

BP is also seeking to divest assets because its debt is too high, Dudley said on the call, constraining his spending power. It has announced about $7bn of a $10bn disposal program linked to the purchase of shale fields from BHP Group last year. And an earlier plan to meet that target by selling older onshore gas fields was complicated by the price of natural gas falling, he said.

BP became the operator of the BHP fields in March, which has now caused other complications to BP's climate ambitions. Dudley said the level of flaring, the deliberate burning of methane at the place it's produced, is "not right," and he is working to reduce it. Earlier this week, the company announced it was adding new equipment to its projects to quantify and identify methane leaks.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

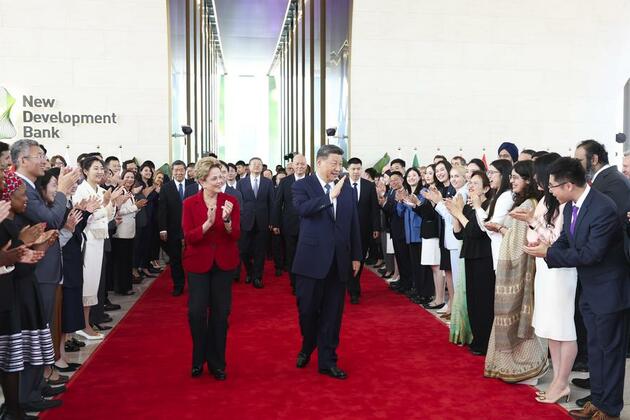

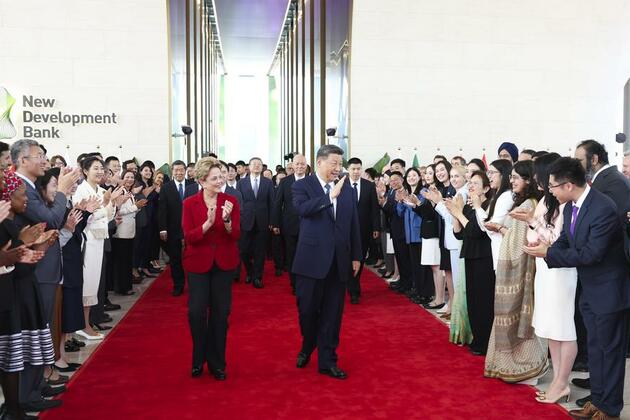

SectionXi pushes for Global South modernization via practical cooperation

BEIJING, July 4 (Xinhua) -- Ahead of Chinese President Xi Jinping's state visit to Brazil late last year, the Portuguese edition of...

Xi's long-standing commitment to Global South development

BEIJING, July 4 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese metropolis of Shanghai sits...

PM Modi receives Guard of Honour in Trinidad and Tobago, welcomed by Caribbean nation's PM, 38 Ministers and 4 MPs

Port of Spain [Trinidad and Tobago], July 4 (ANI): Prime Minister Narendra Modi began his first official visit to Trinidad and Tobago...

Xi Jinping champions the cause of Global South

by Xinhua writer Jiang Hanlu BEIJING, July 3 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese...

Minakshi, Pooja Rani assure India of two medals on Day 3 at World Boxing Cup Kazakhstan

Astana [Kazakhstan], July 2 (ANI): Minakshi (48kg) and Pooja Rani (80kg) guaranteed India two medals on Day 3 of the World Boxing Cup-Astana,...

PM Modi arrives in Ghana, receives guard of honour and 21-gun salute

Accra [Ghana], July 2 (ANI): Prime Minister Narendra Modi arrived in Ghana on Wednesday, marking the start of his five-nation tour....

Business

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...