Most investors believe SA won?t be ?junked?

News24

08 Oct 2019, 14:14 GMT+10

RELATED ARTICLES Eskom's $4bn coal bill headache largely of its own making Ramaphosa to strengthen trade agreements with rest of Africa Foreigners dump South African shares at the fastest pace in two years

After their worst quarter of the year, emerging-market assets head into the final three months of the year facing a set of issues that are just as likely to be obstacles as triggers to a recovery.

The following are responses from 54 investors, strategists and traders across the globe to five questions with potential bearing on developing-nation assets. The survey was conducted between September 19 and 30.

Government has just three weeks left to make tough decisions on Eskom, economy

Investors see the PBOC's one-year medium lending facility rate, paid by commercial banks borrowing medium-term facilities from the central bank, to be trimmed to 3.1% by year-end from 3.3% currently, based on an average of 19 respondents. And the required reserve ratio for major banks, or the share of funds lenders must hold in reserve, will be reduced to 12% from 13%, according to the average of 25 respondents.

4. Key Brazil reform

Will Brazil pass the final vote on the pension bill before the year-end?

Three-quarters of the survey participants expect Brazil's pension-reform bill to be approved this year, seen as a key move toward fiscal discipline in Latin America's largest economy. Upside to Brazilian bonds may be limited given the powerful rally they have seen in recent quarters, however, analysts say. Central bank rate cuts have also already boosted Brazilian debt.

5. US rate assumption

With US rates having a strong bearing on emerging-market assets, is the 10-year Treasury yield more likely to rise above 2.4% or fall below 1.4% by the end of 2019?

Over three-quarters of survey participants expect the benchmark to end the year lower than 1.57% as of 8:45 a.m. in Singapore, possibly below 1.40%. The yield has dropped more than a percentage point this year.

Emerging-market debt has been a beneficiary of lower US rates - in particular, dollar-denominated bonds. The hard-currency debt has outperformed local-currency bonds so far this year, in part due to a strengthening dollar.

share:

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionPM Modi's upcoming Ghana visit to be first by an Indian Prime Minister in three decades: Envoy Manish Gupta

Accra (Ghana) [India], July 2 (ANI): Prime Minister Narendra Modi's upcoming visit to Ghana will be the first by an Indian Prime Minister...

NMDC expands global footprint with its new office in Dubai, forging global pathways in mining

Hyderabad (Telangana) [India], July 1 (ANI): NMDC, India's largest iron ore producer, marked a significant milestone with the inauguration...

FIFA Club WC: Last two QF spots up for grabs as Real Madrid, Dortmund among teams in action

New Delhi [India], July 1 (ANI): The last two spots for the quarterfinals of the FIFA Club World Cup will be sealed by either Spanish...

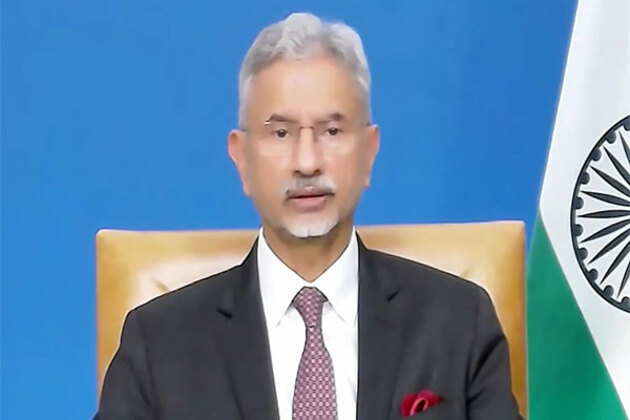

New road will remain as symbol of India-Guyana "deep friendship": Jaishankar as Phase I of Ogle to Eccles portion of the East Coast-East Bank road linkage project is commissioned

Georgetown [Guyana], July 1 (ANI): As Guyana President Irfaan Ali commissioned Phase I of the Ogle to Eccles portion of the East Coast-East...

PERU-CUSCO-INTI RAYMI-INCA FESTIVAL

(250701) -- CUSCO, July 1, 2025 (Xinhua) -- This photo taken on June 20, 2025 shows people celebrating Inti Raymi, or the Festival...

ARGENTINA-BUENOS AIRES-YPF-U.S.-RULING-APPEAL

(250701) -- BUENOS AIRES, July 1, 2025 (Xinhua) -- This photo taken on June 30, 2025 shows a YPF logo in Buenos Aires, Argentina. Argentina...

Business

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...