Digital currencies to be credit negative for banks

ANI

13 Sep 2021, 15:48 GMT+10

Singapore, Sep 13 (ANI): Wide adoption of central bank digital currencies (CBDCs) in cross-border payments and settlements will be credit negative for banks because of lower fees and commissions, Moody's Investors Service said on Monday.

This is particularly for those banks that are active in foreign-currency payments, clearing and remittances, it said in its latest credit outlook report.

It is the first time that the Bank of International Settlements (BIS) and various central banks are testing multiple CBDCs in a single platform for cross-border settlements.

This is an important step if CBDCs are to be adopted beyond domestic transactions. Earlier in 2021, the Singaporean and French central banks successfully tested dual-CBDC cross-border transactions, said Moody's.

On September 3, the BIS together with central banks of Singapore, Australia, Malaysia and South Africa started testing CBDCs for cross-border settlements.

The project called Dunbar aims to build a prototype platform for settlement in multiple CBDCs with the target being faster, cheaper and more secure cross-border payments and settlements between financial institutions.

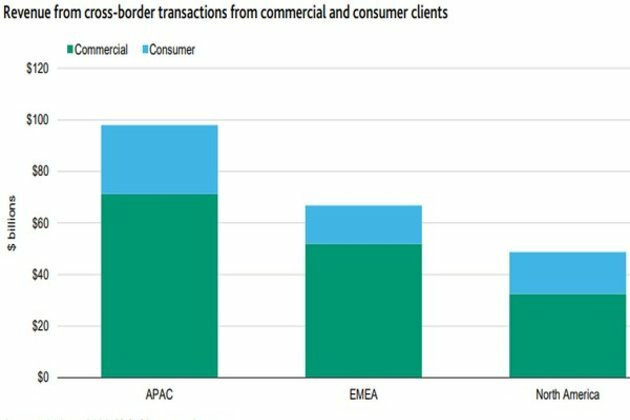

Moody's said the revenue that banks generate from cross-border transactions is significant. Globally, banks generated about 230 billion dollars in revenue from cross-border transactions in 2019, based on data from consulting firm McKinsey.

Banks in Asia Pacific made up 100 billion dollars of this amount, the largest share globally, with most revenue coming from commercial transactions such as bank-to-bank.

According to McKinsey, banks globally generated about 60 billion dollars in revenue in consumer business in 2019 for cross-border transactions such as remittances, where the banks charge hefty fees.

Banks on average charge 6.4 per cent on outward remittances, based on World Bank data, with Nigerian, South African and Thai banks charging some of the highest fees globally. These fees will be reduced with the wider adoption of CBDCs.

It is uncertain if the platform prototypes developed under the Dunbar project will be adopted by other central banks. However, the BIS expects that the results of this project will guide the development of global and regional platforms for more efficient cross-border payments. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionRoundup: Trump targets foreign tourists with higher national park fees

President Trump has ordered higher entrance fees for foreign visitors to U.S. national parks, sparking concerns from environmental...

ECSSR, Anwar Gargash Diplomatic Academy launch first regional edition of 'Hili Forum' in Brazil

ABU DHABI, 4th July, 2025 (WAM) --The Emirates Centre for Strategic Studies and Research (ECSSR) and the Anwar Gargash Diplomatic Academy...

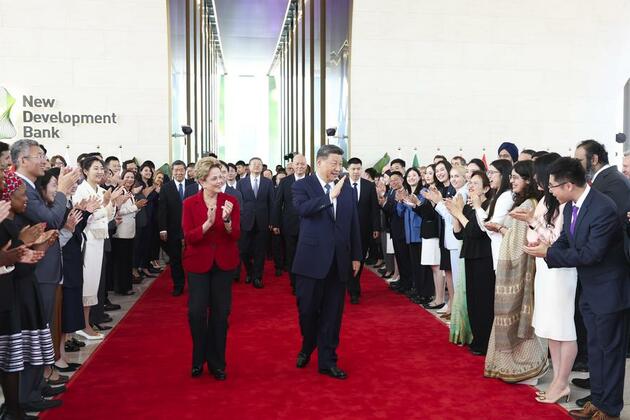

Xi pushes for Global South modernization via practical cooperation

BEIJING, July 4 (Xinhua) -- Ahead of Chinese President Xi Jinping's state visit to Brazil late last year, the Portuguese edition of...

Xi's long-standing commitment to Global South development

BEIJING, July 4 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese metropolis of Shanghai sits...

PM Modi receives Guard of Honour in Trinidad and Tobago, welcomed by Caribbean nation's PM, 38 Ministers and 4 MPs

Port of Spain [Trinidad and Tobago], July 4 (ANI): Prime Minister Narendra Modi began his first official visit to Trinidad and Tobago...

Xi Jinping champions the cause of Global South

by Xinhua writer Jiang Hanlu BEIJING, July 3 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese...

Business

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...