U.S. stocks rally hard despite drop in consumer sentiment

Lola Evans

15 Mar 2025, 01:36 GMT+10

- Investors shrugged off a decline in consumer sentiment.

- "Consumer sentiment slid another 11 percent this month, with declines seen consistently across all groups."

- "Sentiment has now fallen for three consecutive months and is currently down 22 percent from December 24 2024."

NEW YORK, New York - U.S. stocks rallied hard on Friday, boosted by strong rises around the world. Investors shrugged off a decline in consumer sentiment. The University of Michigan reported consumer confidence fell to 57.9 in March, well below the 63.2 expected.

"Consumer sentiment slid another 11 percent this month, with declines seen consistently across all groups by age, education, income, wealth, political affiliations, and geographic regions," the University of Michigan report released on Friday said. "Sentiment has now fallen for three consecutive months and is currently down 22 percent from December 24 2024," the report added.

The data, together with the tariffs-related volatility through the week, failed to dampen the thirst for stocks Friday.

"Consumer sentiment came in worse, inflation expectations are rising, the 10-year Treasury yield is rising. You would think that the market would be off. So a lot of folks are watching to see if this rally has any breadth or legs," Thomas Martin, portfolio manager at Globalt Investments told CNBC Friday.

"What we would like to see is rates not go up, because that would be an indication that the Fed is losing control. If the Fed says they're cutting and rates go up, that's a lack of confidence," Martin said.

Following are Friday's closing quotes for key U.S. markets:

-

S&P 500: The benchmark index rose by 117.42 points, or 2.13 percent, closing at 5,638.94. This surge marked its best day since the post-election rally, driven by a broad-based recovery across various sectors.

-

Dow Jones Industrial Average: The Dow advanced 674.62 points, or 1.65 percent, ending at 41,488.19. The rally was led by notable gains in technology and industrial stocks, signaling renewed confidence among investors.

-

NASDAQ Composite: The tech-heavy index jumped 451.07 points, or 2.61 percent, to close at 17,754.09. This increase was bolstered by strong performances from major technology companies, reflecting a resurgence in the sector.

Market Influences

The robust performance across these indices can be attributed to several factors:

-

Economic Data: Positive economic indicators, including favorable consumer sentiment and retail sales figures, have bolstered investor confidence.

-

Easing Trade Tensions: Recent developments suggest a de-escalation in global trade disputes, alleviating concerns over potential economic slowdowns.

-

Corporate Earnings: Strong quarterly earnings reports from major corporations have reinforced optimism about the resilience of the business environment.

Overall, Friday's market rally reflects a combination of positive economic data, easing geopolitical tensions, and robust corporate performance, contributing to a favorable investment climate.

Global Foreign Exchange Market Overview for Friday

The global foreign exchange market witnessed notable movements on Friday, influenced by escalating trade tensions and shifting investor sentiments.

Major Currency Pairs:

-

EUR/USD (Euro/US Dollar): The euro appreciated by 0.28 percent against the US dollar, closing at 1.0881. This uptick comes despite the euro retreating from a five-month peak earlier in the week, as concerns over global trade tensions and potential economic downturns weighed on the currency.

-

USD/JPY (US Dollar/Japanese Yen): The US dollar strengthened by 0.53 percent against the Japanese yen, ending the day at 148.58. The yen's depreciation is attributed to diminished expectations of the Bank of Japan raising interest rates in the near term.

-

USD/CAD (US Dollar/Canadian Dollar): The US dollar weakened by 0.46 percent against the Canadian dollar, with the pair trading at 1.4369. This movement reflects the broader market dynamics amid ongoing trade discussions between the US and Canada.

-

GBP/USD (British Pound/US Dollar): The British pound experienced a slight decline of 0.10 percent against the US dollar, closing at 1.2931. The UK's unexpected economic contraction of 0.1 percent in January has raised concerns about the nation's economic trajectory.

-

USD/CHF (US Dollar/Swiss Franc): The US dollar advanced by 0.39 percent against the Swiss franc, ending at 0.8850. Investors' consolidation of positions after earlier selling of the greenback contributed to this movement.

-

AUD/USD (Australian Dollar/US Dollar): The Australian dollar rose by 0.62 percent against the US dollar, trading at 0.6322. The currency's appreciation aligns with the broader market trends observed during the day.

-

NZD/USD (New Zealand Dollar/US Dollar): The New Zealand dollar saw the most significant gain among major currencies, appreciating by 0.88 percent against the US dollar to close at 0.5747.

Market Influences:

The day's currency movements were significantly influenced by escalating global trade tensions. U.S. President Donald Trump's threats to impose high tariffs on European alcohol imports have added to market volatility, affecting investor sentiment across various currencies.

Additionally, the UK's economic contraction in January has raised concerns about the nation's economic health, impacting the British pound's performance.

Overall, the foreign exchange market remains sensitive to geopolitical developments and economic indicators, with investors closely monitoring ongoing trade negotiations and economic data releases.

Global Stock Markets Rally on Friday

Global stock markets experienced significant gains on Friday, with major indices across the UK, Europe and Asia closing higher.

Canadian Markets

- S&P/TSX Composite Index: Canada's primary stock index climbed 350.17 points, or 1.45 percent, to finish at 24,553.40. The gains were widespread, with significant contributions from the energy and financial sectors.

UK and European Markets

- FTSE 100: The UK's leading index rose by 89.77 points, or 1.05 percent, to close at 8,632.33.

- DAX Performance Index: Germany's DAX surged 419.68 points, or 1.86 percent, ending at 22,986.82.

- CAC 40: France's benchmark index climbed 90.07 points, or 1.13 percent, to 8,028.28.

- EURO STOXX 50: The Eurozone's top 50 companies saw their index increase by 75.79 points, or 1.42 percent, closing at 5,404.18.

- Euronext 100: This pan-European index advanced 18.47 points, or 1.18 percent, to 1,580.88.

- BEL 20: Belgium's primary index added 45.71 points, or 1.05 percent, finishing at 4,410.12.

Asian Markets

- Hang Seng Index: Hong Kong's market jumped 497.33 points, or 2.12 percent, to 23,959.98.

- S&P/ASX 200: Australia's main index gained 40.60 points, or 0.52 percent, closing at 7,789.70.

- All Ordinaries: Another Australian index, it rose by 46.70 points, or 0.59 percent, to 8,013.30.

- SSE Composite Index: China's Shanghai index increased by 60.83 points, or 1.81 percent, ending at 3,419.56.

- Nikkei 225: Japan's benchmark index advanced 263.07 points, or 0.72 percent, to 37,053.10.

Other Notable Indices

- FTSE Bursa Malaysia KLCI: This Malaysian index edged up 2.12 points, or 0.14 percent, to 1,512.15.

- S&P/NZX 50: New Zealand's index rose by 57.20 points, or 0.47 percent, closing at 12,266.25.

- TWSE Index: Taiwan's market saw a modest gain of 6.37 points, or 0.03 percent, ending at 21,968.05.

- Top 40 USD Net TRI Index: South Africa's index increased by 84.16 points, or 1.80 percent, to 4,771.60.

Declining Markets

Not all markets shared in the gains:

- STI Index: Singapore's index dipped slightly by 1.50 points, or 0.04 percent, to 3,836.02.

- S&P BSE SENSEX: India's benchmark fell 200.85 points, or 0.27 percent, closing at 73,828.91.

- IDX Composite: Indonesia's index dropped 131.79 points, or 1.98 percent, to 6,515.63.

- KOSPI Composite Index: South Korea's market declined by 7.28 points, or 0.28 percent, ending at 2,566.36.

Related stories:

Thursday 13 March 2025 | Dow Jones drops for fourth day in row, loses 537 points | Big News Network

Wednesday 12 March 2025 | Strong gain by Nasdaq Composite helps stem Wall Street carnage | Big News Network

Tuesday 11 March 2025 | Wall Street freefall continues, Dow Jones drops another 478 points | Big News Network

Monday 10 March 2025 | U.S. stock markets shatter, Dow Jones sheds 890 points | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionOrlando City sign 16-year-old M Gustavo Caraballo

(Photo credit: Mark Smith-Imagn Images) Orlando City SC announced the signing of 16-year-old midfielder Gustavo Caraballo on Friday....

"Memories still fresh": Ajit Pal Singh recalls 1975 World Cup glory as Hockey India prepares for its Golden Jubilee celebrations at Annual Awards

New Delhi [India], March 14 (ANI): The Hockey India 7th Annual Awards 2024 is set to bring together the Indian hockey fraternity in...

Xi Jinping -- a champion of mutual learning among civilizations

Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee and Chinese president, attends the CPC in Dialogue...

Jack Draper reaches first ATP Masters 1000 semifinal

(Photo credit: Andy Abeyta/The Desert Sun / USA TODAY NETWORK via Imagn Images) Jack Draper earned one of the biggest wins of his...

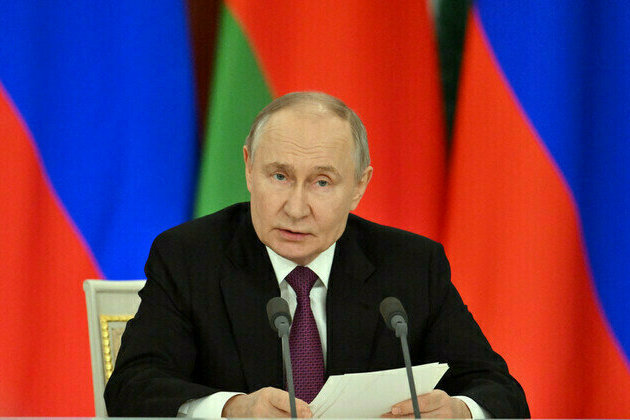

"We agree to ceasefire, but...": Putin thanks Trump, PM Modi for efforts to resolve Ukraine conflict

Moscow [Russia], March 14 (ANI): Russian President Vladimir Putin has made his first public remarks on Ukraine's willingness to negotiate...

READ IN FULL: Putins statement on Trumps Ukraine ceasefire proposal

Russia is ready, the president has said, stressing that such an agreement must lead to long-term peace Russian President Vladimir...

Business

SectionU.S. stocks rally hard despite drop in consumer sentiment

NEW YORK, New York - U.S. stocks rallied hard on Friday, boosted by strong rises around the world. Investors shrugged off a decline...

Maserati cancels electric MC20 plans over low demand

MILAN, Italy: Maserati has scrapped plans for an electric version of its MC20 sports car, citing low expected demand for the high-performance...

Volkswagen to slash 1,600 jobs at Cariad by year-end

BERLIN, Germany: Volkswagen is set to cut 1,600 jobs at its Cariad software division by the end of the year, affecting nearly 30 percent...

Travel to and from Israel to be boosted by terminal reopening

The principal terminal, Terminal 1, at Israel's largest airport will reopen at the end of this month, having largely been closed since...

Tech stocks lead renewed selling on Wall Street

NEW YORK, New York - The knee-jerk introduction of trade tariffs by President Donald Trump continues to rattle markets with all the...

Ford to invest up to $4.8 billion to revive struggling German unit

FRANKFURT, Germany: Ford announced this week that it will inject up to $4.8 billion into its struggling German unit to stabilize its...