U.S. stock markets slide, Dow Jones drops 260 points

Lola Evans

19 Mar 2025, 01:39 GMT+10

- “The markets are going to remain choppy up until whatever decision is made on April 2."

- The euro appreciated against the U.S. dollar, rising by 0.20 percent to reach 1.0943.

- The Dow decreased by 260.32 points, or 0.62 percent, ending at 41,581.31.

NEW YORK, New York - Sellers took charge again on Wall Street Tuesday as the brief rebound that took place on Monday petered out. Stocks such as Nvidia and Tesla were sold off sharply.

"It does appear the market really does want to rotate into things that haven't worked as well and out of things that did work well for the last couple of years, so that may be just what all this is about," Rhys Williams, chief investment officer at Wayve Capital told CNBC Tuesday.

"The markets are going to remain choppy up until whatever decision is made on April 2," Williams added, in reference to the expiry date of the pause on Canadian and Mexican import tariffs.

U.S, markets were also influenced by investor caution ahead of the Federal Reserve's upcoming monetary policy decision and a surprise return to hostilities in Gaza.

Following are Tuesday's closing quotes for the major U.S. stock indices:

S&P 500 (^GSPC): The index fell by 60.46 points, or 1.07 percent, closing at 5,614.66.

Dow Jones Industrial Average (^DJI): The Dow decreased by 260.32 points, or 0.62 percent, ending at 41,581.31.

NASDAQ Composite (^IXIC): The tech-heavy Nasdaq dropped 304.55 points, or 1.71 percent, to close at 17,504.12.

U.S. dollar claws back some losses on foreign exchange markets, but outlook remains uncertain

Here's a summary of the latest forex rates:

EUR/USD (Euro/US Dollar): The euro appreciated against the U.S. dollar, rising by 0.20 percent to reach 1.0943. This uptick is attributed to Germany's plans for significant state borrowing to fund infrastructure and military projects, bolstering the euro's strength.

USD/JPY (US Dollar/Japanese Yen): The pair remained stable at 149.19, showing no percentage change. Investors are cautiously awaiting the Bank of Japan's upcoming policy decisions, contributing to the yen's steady performance.

USD/CAD (US Dollar/Canadian Dollar): The U.S. dollar edged higher against the Canadian dollar, gaining 0.06 percent to reach 1.4296. Ongoing trade tensions between the U.S. and Canada continue to influence this currency pair.

GBP/USD (British Pound/US Dollar): The British pound advanced by 0.12 percent against the dollar, firming to 1.3005. This marks the first time since November that the pound has surpassed the $1.30 mark, driven by persistent UK inflation and a weakening dollar.

USD/CHF (US Dollar/Swiss Franc): The U.S. dollar declined against the Swiss franc by 0.49 percent, falling to 0.8764. The franc's safe-haven appeal has strengthened amid global economic uncertainties.

AUD/USD (Australian Dollar/US Dollar): The Australian dollar depreciated by 0.34 percent against the U.S. dollar, settling at 0.6361. Concerns over global trade tensions and their impact on commodity prices, and fears of a recession, have weighed on the Aussie dollar.

NZD/USD (New Zealand Dollar/US Dollar): The New Zealand dollar saw a slight decrease of 0.03 percent against the greenback, slipping to 0.5817.

World stock markets rally hard, particularly in UK, Europe and Asia

Global stock markets moved ahead on Tuesday adding to gains of a day earlier. Sharp rises on many Asian bourses, as well as across-the-board gains in the UK and Europe were the highlights.

Here's a summary of the closing figures for key indices:

Canada

S&P/TSX Composite Index (^GSPTSE): Canada's primary index declined by 79.04 points, or 0.32 percent, finishing at 24,706.07.

European Markets:

-

FTSE 100 (United Kingdom): The index edged up by 24.94 points, or 0.29 percent, closing at 8,705.23.

-

DAX (Germany): Germany's benchmark index advanced 226.13 points, or 0.98 percent, to finish at 23,380.70.

-

CAC 40 (France): The French index rose by 40.59 points, or 0.50 percent, ending the session at 8,114.57.

-

EURO STOXX 50: This leading blue-chip index for the Eurozone increased by 39.46 points, or 0.72 percent, to close at 5,485.01.

-

Euronext 100 Index: The index gained 10.91 points, or 0.68 percent, concluding at 1,605.94.

-

BEL 20 (Belgium): Belgium's primary index added 22.15 points, or 0.49 percent, closing at 4,500.10.

Asian Markets:

-

Hang Seng Index (Hong Kong): The index surged by 595.00 points, or 2.46 percent, ending at 24,740.57.

-

SSE Composite Index (China): The Shanghai index saw a slight uptick of 3.63 points, or 0.11 percent, finishing at 3,429.76.

-

Nikkei 225 (Japan): Japan's leading index climbed 448.90 points, or 1.20 percent, to close at 37,845.42.

-

STI Index (Singapore): Singapore's benchmark index climbed 35.61 points, or 0.92 percent, to close at 3,894.97.

-

S&P BSE SENSEX (India): India's premier index jumped 1,131.30 points, or 1.53 percent, ending at 75,301.26.

-

FTSE Bursa Malaysia KLCI: The Malaysian index advanced 15.66 points, or 1.04 percent, to close at 1,527.81.

-

KOSPI Composite Index (South Korea): South Korea's benchmark index edged up by 1.65 points, or 0.06 percent, closing at 2,612.34.

-

TWSE Capitalization Weighted Stock Index (Taiwan): The index gained 153.04 points, or 0.69 percent, ending at 22,271.67.

Oceania

-

S&P/ASX 200 (Australia): Australia's leading index saw a modest rise of 6.30 points, or 0.08 percent, finishing at 7,860.40.

-

All Ordinaries (Australia): This broader index increased by 7.80 points, or 0.10 percent, closing at 8,089.90.

- S&P/NZX 50 Index Gross (New Zealand): The index declined by 89.29 points, or 0.73 percent, finishing at 12,076.85.

Middle Eastern Markets:

-

EGX 30 Price Return Index (Egypt): The Egyptian index rose by 150.10 points, or 0.48 percent, ending at 31,608.70.

- TA-125 (Israel): Israel's main index decreased by 27.13 points, or 1.05 percent, closing at 2,564.48.

Africa

-

Top 40 USD Net TRI Index (South Africa): This index increased by 18.51 points, or 0.38 percent, closing at 4,846.33.

Related story:

Monday 17 March 2025 | U.S. stocks rally continues Monday, Dow Jones adds 353 points | Big News Network

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionRaisina Dialogue 2025: Jaishankar holds key meetings with Latvia, Antigua-Barbuda, IAEA and Maldives ministers and leaders

New Delhi [India], March 18 (ANI): External Affairs Minister S Jaishankar engaged in multiple high-level meetings on the sidelines...

Raisina Dialogue 2025: Jaishankar holds key meetings with Ukraine,Thailand, Peru foreign ministers

New Delhi [India], March 18 (ANI): External Affairs Minister S Jaishankar on Tuesday met with Ukraine Foreign Minister Andrii Sybiha...

Argentina: despite the scandals, Milei's politics are here to stay

The Argentinian president, Javier Milei, is going through the toughest moment of his short but remarkable political career. He is facing...

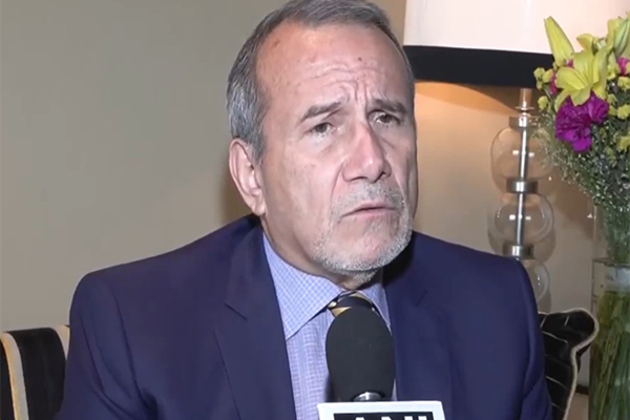

"We need better logistics... construction of naval and aerial hub": Peru Foreign Minister on strengthening economic ties with India

New Delhi [India], March 17 (ANI): Peru's Foreign Minister Elmer Schialer on Monday emphasised the importance of improving logistics...

Argentina MotoGP: Second straight clean sweep for Marquez

Termas de Rio Hondo [Argentina], March 17 (ANI): The MotoGP riders took to the track this Sunday afternoon at Termas de Rio Hondo for...

Pakistan, Afghanistan, and Russia among 43 countries likely to face Trump's new travel ban

Washington DC [US], March 17 (ANI): The Donald Trump administration is considering imposing a new travel ban that could affect citizens...

Business

SectionU.S. stock markets slide, Dow Jones drops 260 points

NEW YORK, New York - Sellers took charge again on Wall Street Tuesday as the brief rebound that took place on Monday petered out. Stocks...

Expansion of Montana coal mine approved by US

WASHINGTON, D.C.: The Trump administration has approved a plan to expand a coal mine in Montana and keep it running for 16 more years,...

Tampa Bay Rays pull out of ballpark project over costs, delays

ST. PETERSBURG, Florida: The Tampa Bay Rays have decided not to move forward with a $1.3 billion plan to build a new stadium next to...

Vietnam, US sign energy and minerals deals amid trade talks

HANOI, Vietnam: As Vietnam seeks to strengthen trade ties and avoid potential U.S. tariffs, companies from both countries signed agreements...

U.S. and world stock markets swamped by buyers Monday

NEW YORK, New York - Profit-takers swooped on Wall Street and global markets Monday, buying up heavily-sold-off stocks. We're in a...

PepsiCo nears $1.5 billion deal to acquire Poppi

HARRISON, New York: PepsiCo is on the verge of expanding its portfolio with a major acquisition. The beverage giant is reportedly in...