Currency controls and debt in Argentina: the stakes are high if Milei's latest economic gamble doesn't pay off

The Conversation

06 May 2025, 15:12 GMT+10

In April, Argentina's president Javier Milei partially lifted the capital and currency controls that had been in place since 2011. The move was possible with the support of a US$20 billion (Pound 15 billion) IMF bailout and means Argentinians may now buy unlimited dollars again.

Announcing the move in the capital Buenos Aires, Milei was flanked by American treasury secretary Scott Bessent. Milei took the opportunity to liken it to US president Donald Trump's "liberation day".

While he is often associated with Trump for his abrasive rhetoric and right-wing populist support base, Milei's liberation day was intended to reduce the role of the state in the economy - unlike the US's approach of deepening it.

The latest iteration of currency controls was implemented by then-president Cristina Fernandez de Kirchner to try to shore up the deteriorating value of the Argentinian peso.

The controls, known locally as el cepo (the clamp), meant that citizens and businesses were limited in the amount of foreign currency they could purchase. At the same time, they were constrained in moving money out of Argentina. This was designed as a safeguard against capital flight, but in effect it stifled inward investment.

These measures, coupled with a centrally controlled foreign exchange rate, created a lucrative black market for US dollars. Citizens were eager to exchange cash pesos for the traditionally safer US dollar.

The currency controls were previously lifted by another advocate for market-friendly policies, president Mauricio Macri in 2015. But they were reimposed in 2019 at the end of his term to address a fall in value of the peso.

Unlike Macri's broad-brush removal, Milei is phasing out the controls. He is doing so in the context of less economic volatility and a more stable national budget.

The measures announced this time mean that rather than being fixed, the peso will be able to float between a value of 1,000-1,400 pesos (64p-87p) per US dollar. Milei's previous policy was a crawling peg, which meant that the peso was pegged to the dollar, but it was prevented from depreciating by more than 1% each month.

However, this was costly. The central bank had to provide the liquidity and has spent US$2.5 billion since mid-March propping up the official rate of the peso.

Floating it means its value is determined by the currency markets. This exposes it to volatility, but the currency band provides some security and the central bank can go back to focusing on building its reserves.

For international companies, future capital can be repatriated out of Argentina (which had been a major barrier to investment). Under the previous restrictions, any profits made by international firms could not be moved out of the country.

And while Argentinians can now buy unlimited dollars through banks, there is still a US$100 restriction on exchanging physical cash.

Analysts have called Milei's move bold and brave, but also described it as a high-stakes gamble. Recent attempts to do the same thing ended in capital flight, near bankruptcy and ultimately the re-imposition of controls.

But it was also a step that he promised on the campaign trail in 2023. Back then, Milei argued that economic stability and deregulation were essential to attract investment into Argentina.

So while the Trump administration looks inwards, Milei is opening Argentina to the private sector - especially in relation to its vast natural resources including shale oil and gas, and lithium.

Extraction of Argentina's shale oil and gas has slowed in recent years, but attracting foreign investment in infrastructure has been high on Milei's priority list. Business, including US energy giant Chevron, seems cautiously optimistic.

And increased foreign investment in Argentina's lithium mining sector has raised hopes that the country could be a linchpin in the global energy transition. But at the same time it is deepening Argentina's dependency on finite commodities.

But what does all this mean for Argentinians right now? For many old enough to remember, it might seem like deja vu. Opening Argentina up to the forces of the market, reducing the regulatory role of the state and privatising major state assets while borrowing more from the IMF has precedent.

It was the same approach followed by president Carlos Menem in the 1990s. This had initial success but over the course of the decade resulted in economic disaster, unsustainable debt (leading to the 2001 IMF debt default) and pushed nearly 60% of the population into poverty.

The US$20 billion IMF loan package (alongside other borrowing) provides Argentina's central bank with capital to lift the currency restrictions. Adding to the IMF debt burden (which already stood at more than US$40 billion in March 2025) has so far been well received by the markets.

But market-friendly policies being well received by the markets is surely to be expected. What might the social costs be, however?

Milei's programme of deep austerity included cuts to salaries and welfare payments. These initially pushed poverty levels up to 53%, their highest point in two decades. Recent figures show that, while still frighteningly high, falling inflation has helped bring this down to 38%.

But these figures mask the desperate reality of many. Reductions in state spending and the removal of subsidies mean that income levels for workers and pensioners are below 2023 levels. Many are taking on additional and more precarious work, and soup kitchens are proving essential.

So for many citizens, the news about the partial lifting of currency controls is a moot point. For these people, buying dollars is not remotely feasible.

One thing Argentinians are broadly united in is their disdain for the IMF. Borrowing from it has pushed Argentina to the brink previously - Milei will be hoping that by jettisoning one anvil, his deal with the IMF won't chain him to a heavier one.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Brazil Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Brazil Sun.

More InformationSouth America

SectionNetanyahu welcomes Ecuador's President Daniel Noboa

JERUSALEM - Despite a looming escalation of the war in Garza with tens of thousands of reservists being called up for a major ground...

Brazil and Russia could play soccer friendly - media

The two countries may face each other later this year, Brazilian media have reported, citing the national football confederation ...

Brazil and Russia could play soccer friendly media

The two countries may face each other later this year, Brazilian media have reported, citing the national football confederation ...

Currency controls and debt in Argentina: the stakes are high if Milei's latest economic gamble doesn't pay off

In April, Argentina's president Javier Milei partially lifted the capital and currency controls that had been in place since 2011....

FGV hosts UAE Minister for International Cooperation for strategic fireside chat on BRICS 2025, bilateral cooperation with Brazil

RIO DE JANEIRO, 6th May, 2025 (WAM) -- The Fundacao Getulio Vargas (FGV), through its International Affairs Division (FGV DINT), in...

Bad Bunny announces global tour: Concerts to be held in Japan, Brazil and more

Washington DC [US], May 6 (ANI): After wrapping a 30-date residency in his home island of Puerto Rico on September 14, the reggaeton...

Business

SectionChinese homeowners slash prices amid resale glut

BEIJING, China: Homeowners in China are slashing prices to attract buyers as a growing number of resale properties flood the market....

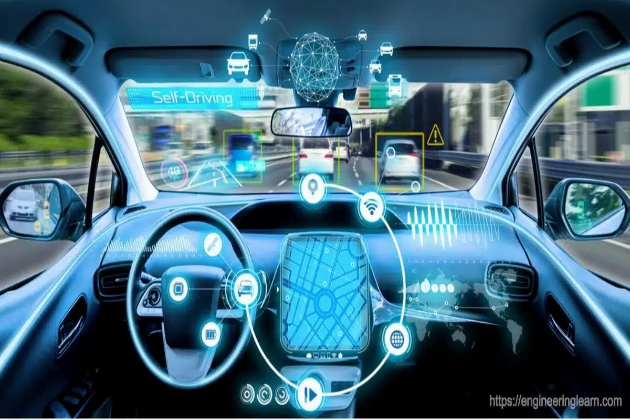

Toyota partners with Waymo to advance self-driving car tech

TOKYO, Japan: Toyota is taking a fresh step toward autonomous driving by teaming up with Waymo to co-develop new vehicle platforms...

U.S. stocks finish with modest losses Monday

NEW YORK, New York - U.S. stocks were volatile Monday as the focus remained on tariffs, and the perceived lack of trade deals despite...

Amazon expands rural delivery network by investing $4 billion

SEATTLE, Washington: Amazon.com is ramping up its delivery game in rural America, announcing a US$4 billion investment to grow its...

Starbucks boosts staffing, slows automation push

SEATTLE, Washington: Starbucks is shifting course on its store strategy—putting people ahead of machines. The coffee giant announced...

China's factory activity shrinks at fastest pace in over a year

BEIJING, China: China's manufacturing sector lost steam in April, with activity shrinking at the fastest pace in over a year, as new...